Trends and Strategies for Acquiring a Business Manager Visa

From April 2015, the residency status previously referred to as “Investment & Management" was changed to “Business Manager". Until then, investment was necessary to manage a company in Japan, but to attract excellent managers from overseas, it was decided that investment was not necessarily required.

However, legally, for managing a company with the “Investment & Management" residency status, it was still required that the company have a capital of more than 5 million yen. However, for a while from April 2015, the Immigration Bureau permitted the “Business Manager" visa as long as the company’s register confirmed that it had a capital of more than 5 million yen.

However, many applications for “Business Manager" visas/residence status were found to be fraudulent, such as cases where there was no actual investment of 5 million yen, or companies were established with borrowed money as capital, so the Immigration Bureau completely changed its stance and started strictly examining whether more than 5 million yen was actually invested, whether business was really being conducted, and whether the business had stability.

Currently, obtaining a “Business Manager" visa/residence status has become very difficult. You will definitely not be allowed to apply for a “Business Manager" visa/residence status if you have a half-hearted intention of not actually doing business but staying in Japan to work.

However, if you truly want to do business in Japan and have a burning desire to succeed, you can certainly obtain a “Business Manager" visa/residence status. However, there is a certain pattern to the documents required by the Immigration Bureau. To obtain a “Business Manager" visa/residence status, it is not enough to simply have the intention to do business; you also need to prepare documents according to this pattern.

In this column, I will share without reservation the tendencies and countermeasures of the documents required by the Immigration Bureau to definitely obtain a “Business Manager" visa/residence status.

- 1. Jobs you can do with a “Business Manager" visa / residence status

- 2. Requirements for the “Business Manager" Visa / Residence Status

- 2.1. What does “securing a place of business" mean?

- 2.2. About the Scale of Business

- 2.3. Who pays the capital?

- 2.4. Is it okay to use borrowed money as capital?

- 2.5. About Hiring Two or More Full-Time Employees

- 2.6. Is it okay if it’s a sole proprietorship?

- 2.7. Should it be a joint-stock company or a limited liability company?

- 3. “Business Manager" Visa / Residency Application Process

- 4. Writing an Extremely Important Document: The Business Plan

- 4.1. Outline of a “Business Manager" Visa Business Plan

- 4.2. Business Plan 1. Company Overview

- 4.3. Business Plan 2. About the Collaborator

- 4.4. Business Plan 3. Background of the Start-up

- 4.5. Business Plan 4. Fundraising

- 4.6. Business Plan 5. Overview of the Business

- 4.7. Business Plan 6. Details of the Business

- 4.8. Business Plan 7. Explanation of the Business Location

- 4.9. Business Plan 8. Employment Contracts for Workers

- 4.10. Business Plan 9. Basis for Accumulation of Sales and Profit and Loss per Month

- 4.11. Business Plan 10. Income Statement for 2 Years

- 5. Required Documents for “Business Manager" Visa/Residence Status

- 6. Starting a Business with Permission for Activities Outside Qualifications!

Jobs you can do with a “Business Manager" visa / residence status

There are two types of jobs that can be done with a “Business Manager" visa / residence status: “Management" and “Administration"

Jobs that can be done with a “Business Manager" visa/residence status are often thought to be company management, but that’s not all. Just as the words “Management" and “Administration" are used, this visa is intended for “managers" and “administrators".

Manager: Company manager. Such as a president, chairman, CEO, etc.

Administrator: Department head, branch manager, factory manager, etc.

As such, there are two types of jobs that can be done with this visa.

Also, this visa is often thought to be for managing a company that you create yourself (in the case of a manager), but that’s not the case. On the contrary, what the government envisages is, like the former foreign president of the recently troubled automobile company, to attract excellent professional managers from overseas for existing companies.

Therefore, not only for newly created companies, but also for existing companies, if you are the manager, you can obtain the “Business Manager" visa / residence status.

Also, about administrators, there are people who simply have titles like director or manager and actually plan to get a visa at a small company with 2-3 employees, but you can’t get a visa as an administrator at a small company. You need to be in a position to manage at least tens of people, and you also need to explain the necessity for that person to manage.

Specific examples of jobs that can be done and cannot be done with a “Business Manager" visa / residence status

The things that can be done with a “Business Manager" visa / residence status are company management or administration, but the problem is what exactly that is. According to the immigration bureau’s materials, it is written as “deciding on 'important matters’ related to business management", “executing work", “auditing work, etc.", but it’s still unclear.

What can and cannot be done in daily work? There is a similar visa called “Engineering / Humanities / International Services". You can do work within this range with “Business Manager".

For example, in the case of restaurant management, you can do sales, marketing, and accounting. However, you cannot cook in the kitchen or serve as a waitress in the hall.

In business plans and other documents, you must not write about doing simple tasks on site.

Requirements for the “Business Manager" Visa / Residence Status

The “Business Manager" visa/residence status is designed for managers and administrators. Depending on whether the applicant applies as a manager or an administrator, some of the approval requirements differ.

- A place of business within Japan must be secured for the business. However, if the business has not yet started, facilities to be used for the business must be secured within Japan.

- The scale of the business must meet one of the following criteria:

– Employ two or more people other than the manager, who are either Japanese, spouses of Japanese citizens, permanent residents, spouses of permanent residents, or long-term residents.

– The total amount of capital or investment is 5 million yen or more.

– It is recognized to be of a scale comparable to the above. - If the applicant is an administrator, they must have more than 3 years of experience as a manager or administrator (including periods of studying management or administration subjects in graduate school) and they must earn a salary equal to or greater than that of a Japanese person in a similar position.

What does “securing a place of business" mean?

If you are working as a manager or administrator of an existing business, you must have secured a place of business to carry out the business. This is obvious because the business is already in operation.

However, for a business that is about to start, it is sufficient to have secured the facilities (location) only. In other words, even if you just have a rental contract for a property, and the property is not yet set up as a place of business, that’s fine. Most applications will pass the review with this, although there are occasional reviewers who require the interior and exterior to be properly arranged. I wish there would be a uniform interpretation on this matter.

You would want to secure office space

As I wrote in the section on “Specific examples of jobs that can and cannot be done with a 'Business Management’ visa", you cannot do on-site work with a 'Business Management’ visa. You can do jobs like managing the company, sales, marketing, accounting, legal affairs, etc. Therefore, you need to prepare an office or at least an office space for the manager. Otherwise, it would be assumed that you are going to do on-site work.

Should you move the registration to the place you rent in the company’s name?

In most cases, a place of business is not secured at the time of company formation. This is because the company is formed first and then a contract for the place of business is made in the company’s name. Therefore, when you form a company, you register it at an address such as your home.

Afterwards, should you change the registered address after you have contracted a place of business in the company’s name? I often hear the opinion of administrative scriveners saying that you should change the registration, but so far, almost all of my clients have obtained their 'Business Management’ visa / residence status without changing the registration.

In the business plan, just writing, 'Registered address: xxxxxxx, Business location: xxxxxxxx’ has been sufficient to receive approval.

About the Scale of Business

Regarding the scale of the business, you only need to meet one of the three criteria. In most cases, applicants apply by meeting the criterion of having a capital of 5 million yen. Hiring full-time employees will cost you more than 5 million yen considering their annual salary, and it’s unclear what a scale 'equivalent to this’ means.

Sometimes, I am asked whether a capital of 2.5 million yen with one full-time Japanese (permanent resident) employee would qualify as an 'equivalent scale’, but this won’t work.

Who pays the capital?

This is often misunderstood, but some people think that the applicant must pay all the capital of 5 million yen or more, but this is not the case. If the applicant is a manager, it might be common for the applicant to pay all of it, but it’s okay if this is not the case due to various circumstances.

If you are managing an existing business, there may be many cases where you do not bear any of the capital at all.

Also, if you are starting a business with multiple members, it’s possible that everyone shares the capital, one person applies for the 'Business Management’ visa/residence status, and the other members apply for the 'Engineer/Specialist in Humanities/International Services’ visa.

Also, even in the case of a new business, as long as you explain the circumstances properly, it’s okay if the applicant doesn’t bear any of the capital (for example, if there’s a parent company and the new company’s management is entrusted to a foreigner).

Is it okay to use borrowed money as capital?

Just borrowing money and using it as capital won’t make your visa application disapproved. If you can’t prepare the capital on your own, you might borrow from parents, siblings, or relatives. However, there are a few points to be cautious about.

For example, if you borrow the entire amount, the question arises whether a person who can’t even prepare a certain amount of money will be considered capable of starting a business and managing it stably. Even if you are going to borrow, it’s better to only borrow a part of it.

Also, who you borrow from can be an issue. If it’s a parent or sibling, it’s probably fine, but borrowing from a friend could be negatively evaluated. Would you casually lend millions of yen to a friend? There’s a possibility that it could be seen as a temporary “show money".

Still, if you are going to borrow, you will create a money lending contract and a repayment plan. A necessary revenue stamp (1,000 yen) should be affixed to the money lending contract. I have seen cases where an application was disapproved due to a missing stamp. If you’re going to borrow money, you need to make a legally valid contract correctly, rather than borrowing it carelessly.

About Hiring Two or More Full-Time Employees

This is also often misunderstood, but hiring two or more full-time employees doesn’t necessarily mean they have to be Japanese or “permanent residents". Foreigners holding a visa/residence status of “Spouse, etc. of a Japanese national", “Spouse, etc. of a permanent resident", or “Long-term resident" are also acceptable. However, it’s not okay if they hold a work visa such as “Engineer/Specialist in Humanities/International Services" or “Skill". It’s strictly limited to individuals who can maintain their visa status without this company acting as a sponsor.

Is it okay if it’s a sole proprietorship?

This is another frequently asked question. Legally, it doesn’t matter whether it’s a corporation or a sole proprietorship, but if you’re a sole proprietorship, which has no concept of capital, and you’re trying to meet the requirement of “having a total investment of 5 million yen or more", you have to have spent more than 5 million yen. If you’re not planning on spending over 5 million yen in advance on equipment or inventory, it would be better to incorporate.

Should it be a joint-stock company or a limited liability company?

I often receive questions about whether it’s better to form a joint-stock company or if a limited liability company is fine. It seems that a joint-stock company might have a slight advantage for visa approval, albeit small.

Forming a joint-stock company takes more effort and cost. The effort and money spent on establishing the company shows your seriousness. Additionally, and this is quite important, in the case of a joint-stock company, you cannot establish it unless the bank can confirm the capital, while a limited liability company can be established even if the capital cannot be confirmed. In that sense, you can say that a joint-stock company has a slightly higher credibility. However, as the Immigration Bureau scrutinizes capital strictly, the advantage of a joint-stock company is just a slight one.

“Business Manager" Visa / Residency Application Process

There are two main patterns in the process to obtain a “Business Manager" visa/residency status. One is a case where a person who is already living in Japan with some sort of residency status applies for a Change of Status of Residence to change their residency status to “Business Manager". The other is a case where a foreigner living overseas applies for a Certificate of Eligibility for Resident Status to obtain a “Business Manager" visa/residency status.

In the latter case, since you are not in Japan, it can be difficult to enter into contracts with business premises or business partners, and many do not have a bank account in Japan (if they have not lived in Japan before), hence a reliable collaborator within Japan is required.

If the Applicant is Living in Japan

1. Planning Phase

In the planning phase, the contents of the business you will start are examined. Specifically, things such as the company name, address, purpose of the company, and other contents to be written in the articles of incorporation, to concrete details of the business itself, products handled, business partners, customers, sales, expenses, profits, etc. are clarified. The contents examined here are organized later as a “business plan".

Next, you prepare the seal certificate necessary for establishing a company and create items such as the company’s seal.

2. Company Establishment Phase

The first step in establishing a company is creating the articles of incorporation. Samples for the articles of incorporation are available on the Ministry of Justice’s website, along with the company registration documents.

It is necessary to affix a 40,000 yen revenue stamp to the articles of incorporation, but it is not required if you sign electronically.

Once the articles of incorporation are created, in the case of a joint-stock company, you need to have the articles authenticated at the notary public’s office. The authentication fee is 50,000 yen. In the case of a limited liability company, authentication is not required, and the registration and license tax at the Legal Affairs Bureau is 150,000 yen for a joint-stock company, while it is 60,000 yen for a limited liability company. So, if you want to save money, we recommend a limited liability company.

In the case of a joint-stock company, after the articles of incorporation have been authenticated, you will make a deposit for the capital. You deposit or transfer money into the promoter’s bank account and make a copy of the passbook.</p

3. Application Phase

After your company has been established, the next step is to apply for a Change of Status of Residence to a “Business Manager" residency status. This application can be made at the regional immigration bureau that has jurisdiction over your place of residence.

The required documents include a “Application for Change of Status of Residence" form, your passport and residence card, a photo, documents that prove the activity that you are permitted to engage in, documents that prove the office for the activity, and a document that certifies your position and the amount of your salary.

If the Applicant is Living Overseas

1. Planning Phase

Similar to the case where the applicant is living in Japan, you need to plan the contents of the business you will start. You will need a business plan that includes the company name, address, purpose of the company, and details about the products you will handle, business partners, customers, sales, expenses, and profits.

As it can be difficult to sign contracts with business premises or business partners from overseas, you will need a reliable collaborator within Japan who can help you with these processes.

2. Company Establishment Phase

Once your business plan is ready, you can proceed with establishing your company. You will need to create the articles of incorporation and have them authenticated if you are establishing a joint-stock company. Also, remember to prepare for the required fees and taxes.

3. Application Phase

Once your company has been established, you can apply for a Certificate of Eligibility for Resident Status. This is done at a regional immigration bureau in Japan, so your collaborator within Japan will need to do this on your behalf. The required documents are similar to those required for a Change of Status of Residence application.

Once your application has been approved, you will receive a Certificate of Eligibility for Resident Status. You can then apply for a visa at a Japanese embassy or consulate in your home country. After receiving your visa, you can enter Japan and start your business.

4. Visa Application Phase

In the process from steps 1 to 3, the minimum necessary documents for applying for a “Business Manager" visa/residency status have been created. However, the documents created in steps 1 to 3 (such as articles of incorporation and company register) are just the minimum, and they alone are not sufficient to obtain a “Business Manager" visa/residency status.

As mentioned above, when obtaining a “Business Manager" visa/residency status, it’s crucial to prove through documentation that the business genuinely has an investment of over 5 million yen, the business is genuinely being conducted, and the business has stability. In order to do this, it’s necessary to submit various additional documents.

If the Applicant is Living Overseas

If the applicant lives overseas and applies for a Certificate of Eligibility for Resident Status, the process is exactly the same: 1. Planning Phase, 2. Company Establishment Phase, 3. Preparation Phase, 4. Visa Application Phase. However, who leads this process will differ.

Collaborator in Japan is Needed

If the applicant lives overseas and isn’t in Japan, a collaborator residing in Japan who can manage the company (a Japanese citizen, a “Permanent Resident", or a “Business Manager", etc.) is necessary. This collaborator will deposit the capital into their bank account and, as the representative, will rent the business premises.

Often we are asked, “I don’t have any trusted friends or relatives in Japan. Can a lawyer or administrative scrivener do everything for me?" While it’s possible, in reality, depositing over 5 million yen into my bank account might be challenging in practice.

Only a truly trusted person can become a collaborator in this case.

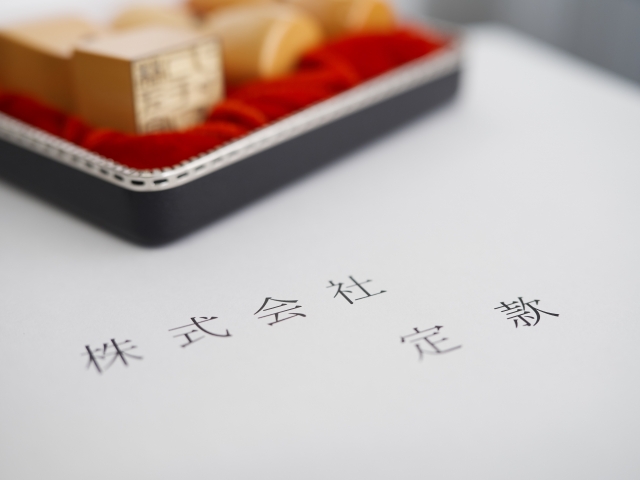

Establish a Limited Liability Company and Make the Collaborator a Co-Representative

The first thing the collaborator does is become a co-representative of the company. In other words, both the visa applicant and the collaborator will become representatives of the newly established company.

In this case, establishing a Limited Liability Company is simpler than a joint-stock company. For joint-stock companies, a seal certificate of all directors is required. In the case of foreigners, they don’t have it, so they need to create a signature certificate, authenticate it at an office or notary public in their home country, and translate it into Japanese.

For a Limited Liability Company, only a seal certificate of at least one representative is needed, so the company can be established just with the seal certificate of the collaborator.

Deposit Capital into the Collaborator’s Bank Account

Once the articles of incorporation are complete, you will make the capital investment. This must be done in a Japanese bank account, so if the applicant does not have a Japanese bank account, the capital is deposited into the collaborator’s bank account.

Register the Seal at the Legal Affairs Bureau in the Name of the Collaborator

Finally, when registering the company, you register the seal of the representative. At this time, you register who can use this seal, along with their personal seal (and seal certificate).

As it might be difficult to understand just by reading, I will attach a sample.

By doing this, even if the principal is not in Japan, the collaborator can rent business premises or make contracts with other companies as the representative of the company. Also, the collaborator can make declarations to the tax office as a representative.

Writing an Extremely Important Document: The Business Plan

When an existing company welcomes a foreign manager and applies for a “Business Manager" visa, it is sufficient to submit documents such as the company’s registry, financial statements, and other documents that provide an overview of the company. However, if the business is just starting, there won’t be any financial statements, so a “business plan" must be submitted.

The business plan submitted to the immigration office differs from the one created for receiving financing. It needs to be formed in a certain way that the immigration office expects.

To create this, it’s not enough to just read a book on “how to write a business plan". It needs to be created based on experience from applying for a “Business Manager" visa time and time again.

Outline of a “Business Manager" Visa Business Plan

Below is an outline of a business plan for obtaining a “Business Manager" visa. While there might be other ways to write it, based on my experience, this is the best approach.

- Company Overview

- About the Collaborator

- Background of the Startup

- Capital Procurement

- Business Overview

- Business Details

- Description of the Business Location

- Employee Hiring Plan

- Basis for Calculating Monthly Sales and Income/Expenses

- Income and Expenditure Plan for Two Years

Business Plan 1. Company Overview

This is the introduction to the business plan, where you briefly write about things similar to what is in the company registry. Although it’s not mandatory to write this, it helps to give the plan a proper form.

The important thing to note here is if the registered address and the business address are different. In that case, you write:

Registered Address: 123 XXXX, Shinagawa-ku, Tokyo

Business Address: 456 XXXX, Toshima-ku, Tokyo

It’s okay if the registered address and the business address are different. As far as we know, to this date.

Business Plan 2. About the Collaborator

As mentioned above, if the applicant is overseas, a collaborator living in Japan will become a co-manager and prepare various things. In such a case, it would be better to initially explain who this collaborator is, and what role they are playing in the application or preparation of the business.

Business Plan 3. Background of the Start-up

There should be a reason to start any business, and that’s what you’ll write here. There are many people who start a business just because they see others doing it or because they want to stay in Japan and there’s no other visa that seems obtainable, but it’s essential to write this down as properly as possible.

Usually, starting a business is related to what you’ve learned or researched at school or what you’ve experienced as a salaried worker. For example, starting a business based on the results of research at university or graduate school, or establishing an IT company because you’ve been working as an IT engineer.

If a person who has been a normal student without any social experience starts a common business (restaurants or used car export are common), it’s hard to believe that it will become a stable business.

You should try to explain the background of your start-up in connection with what you’ve learned and experienced as much as possible.

There may also be cases where you link it to trends in Japan and the world, market trends

Separate from your academic background and experience, there might be businesses needed as a trend in society. For example, businesses needed for the upcoming Olympics, or businesses that cater to the increasing number of foreign tourists.

Analyzing such trends and explaining, “If I do this kind of business, it’s bound to hit" would also belong in this section.

Business Plan 4. Fundraising

“Total amount of investment over 5 million yen" is a requirement for the “Business Manager" visa, so it’s necessary to properly explain and prove this.

Even if you have a high income or assets, you will need to submit tax certificates, copies of savings passbooks, and other asset documents as proof and explain.

When a client of mine, the wife of an executive of a well-known large foreign company, started a business, she was asked to submit documents regarding her husband’s income in his home country.

Especially for people who don’t have much income to begin with, students, or people without assets, you need to carefully collect evidence and explain.

Basically, it’s the documents that prove the person’s income (several years of tax certificates, etc.), copies of savings passbooks, records of remittances from home countries, copies of home country’s passbooks, proof of home country’s income, etc.

If you borrow or are given money by someone, it’s the income proof of the lender or donor, copies of savings passbooks, remittance records, etc.

If you borrow from someone other than family, you’ll need to get a reason letter from the lender explaining why they’re lending you the money. At that time, they need to write down the reason for lending thoroughly. If it’s an amount in the order of millions of yen, a simple “I lent it because they’re my friend" won’t suffice.

Also, as mentioned above, if you borrow money, you must properly create loan agreements and repayment schedules.

Business Plan 5. Overview of the Business

This isn’t a section to think deeply about. You simply explain what kind of business you’re going to do in a way that’s easy to understand. You’ll want to clearly describe what kind of products or services you’re going to offer to which customers.

Also, if there are unique features that differentiate your business from others, write about them here.

Business Plan 6. Details of the Business

When applying for a “Business Manager" visa, it is extremely important to explain the details of your business and demonstrate through attached documents that preparations are well underway. While this wasn’t as critical in the past, recently it’s become impossible to receive visa approval without detailed explanations.

The approach to writing the “Details of the Business" may vary depending on the nature of your business. Here, as a typical example, I would like to explain a business model that involves procuring and selling products.

Description of the Products

You need to describe what kind of products you will deal with. Don’t just end with a single word like “used cars"; explain their features, classifications, and such. If you procure different types of products from different sources, you will want to explain such classifications as well.

Description and Evidence of Suppliers

Explain from where you will procure the products you described above. If different types of products are procured from different suppliers, explain clearly, such as xxx is from Company A, xxx is from Company B, and so on.

For suppliers, you should list the company name, address, phone number, etc., and attach documents to prove that you can actually procure products from these companies, such as purchase agreements or memoranda. Although this may seem like a high hurdle if you have not yet started your business, immigration will definitely demand it. So, prepare as much as you can. You’re not expected to have contracts with all listed companies, but you’ll want to prepare contracts with about three companies.

If, by any chance, you can’t prepare any contracts, or if you can deal even without contracts, then go ahead and procure the products. Make purchases worth tens of thousands to hundreds of thousands of yen from each company, and use the receipts, invoices, and photos of the stock as evidence.

Description and Evidence of Customers

When writing a business plan, you should list customer names, addresses, phone numbers, and categories of products sold. It may be relatively easy to write, but proving this can suddenly become difficult.

There may be corporate customers as well as individual ones, and there may be wholesale and retail sales. I think it would be very difficult to prove that you have secured customers for the business you are about to start.

However, immigration will require you to prove that you have secured customers to some extent.

If you’re exporting, you might have some customers secured, such as companies in your home country. If you have such companies, you should prepare and submit copies of sales contracts or memoranda as evidence.

Even for domestic sales, if your customers are wholesalers or corporations, you may be able to prepare contracts to some extent.

The problem is when dealing with individuals at retail. In this case, you can’t prepare contracts, so you either have to prepare something else, or give up on providing evidence for individuals, explain the situation, and submit only documents for corporate customers.

The “something else" could be a contract with a shopping mall like Rakuten if you’re selling online, or setting up an online store. Also, if you’re retailing at a shop, it could mean securing a shop (which is the same as securing a business location).

You’ll have to think about this on a case-by-case basis.

Business Plan 7. Explanation of the Business Location

Securing a business location is also a requirement for approval of the “Business Manager" visa and residency status, so you need to prepare and explain it properly in your business plan.

Essentially, what’s important is that you have rented a space in the company’s name for the purpose of the business, and that the office space is secured. If these conditions are met, you attach a copy of the lease agreement, a layout plan of the property, and several photos showing the exterior and interior.

Naturally, the property needs to be suitable for the purpose of the business, such as a warehouse for a business that carries inventory, or a food-service property for a restaurant.

For businesses that only require an office, a rental office is acceptable, but since you need to secure a business location continuously, a contract for more than two years is required.

A shared office without a private room won’t be acceptable.

Business Plan 8. Employment Contracts for Workers

Since the “Business Manager" visa is intended for managers, the jobs that can be performed with this visa are limited. Fundamentally, they are jobs related to management, but they also allow for jobs that can be performed with a “Technology, Humanities, International Services" visa.

This means, if a company’s operations only involve work that can be done with a “Technology, Humanities, International Services" visa, a single applicant can manage the company. However, if the main operations involve work that cannot be performed with this visa, employees must be hired.

For example, in a restaurant, you need to hire chefs and waitstaff, and if your business involves cleaning hotels, you need to hire cleaning staff.

In such cases, it is necessary to explain your employee hiring plan, and it’s even required that you secure or contract chefs, for instance, by providing their personal names in advance.

For instance, if a foreigner living abroad plans to open a restaurant in Japan, it is necessary to apply for their visa and the chef’s visa simultaneously.

For example, in an export business, all operations can be conducted within the scope of a “Technology, Humanities, International Services" visa, so the business can be started by the applicant alone. In this case, it is not necessary to write an employment plan. However, if there are plans to hire someone immediately after starting the business, writing this in advance in the business plan can be beneficial when acquiring a visa for the employee.

Can you hire employees immediately after starting a business (Can employees get work visas)?

It is often misunderstood that it is difficult to hire employees (or for employees to obtain visas) immediately after starting a business, but this is the opposite. If the employment contract is written in the business plan and the cost is properly calculated in the income and expenditure plan, it is rather easier to obtain a visa for the employee if you hire quickly.

Business Plan 9. Basis for Accumulation of Sales and Profit and Loss per Month

In parts 9 and 10 of the business plan, the plan of the business is explained in numbers.

The numbers for the business are explained as “sales – expenses = profit and loss", and in part 9 of the business plan, once the business is on track, such as 12 months after starting the business (this is an approximate figure), the sales, expenses, and profit and loss are explained.

Even if you can run the business on your own, it’s better to write an employment plan

Especially for sales, the immigration bureau will ask for the “basis for accumulation". The basis for accumulation is the rationale for how much of which product will be sold to whom.

For example, if you simply say, “In December of this year, sales will be 3 million yen," it is not clear why it will be 3 million yen. Therefore, explaining this basis is part 9 of the business plan.

There is no specific rule on how to write it, but it would look something like this:

A product Unit price 100,000 yen x 20 pieces

B product Unit price 200,000 yen x 10 pieces

C product Unit price 500,000 yen x 2 pieces

Purchase cost: 2 million yen

Other expenses: 1 million yen

In this way, you show the basis for accumulating sales for about one month, using a time when the business is on track as a sample.

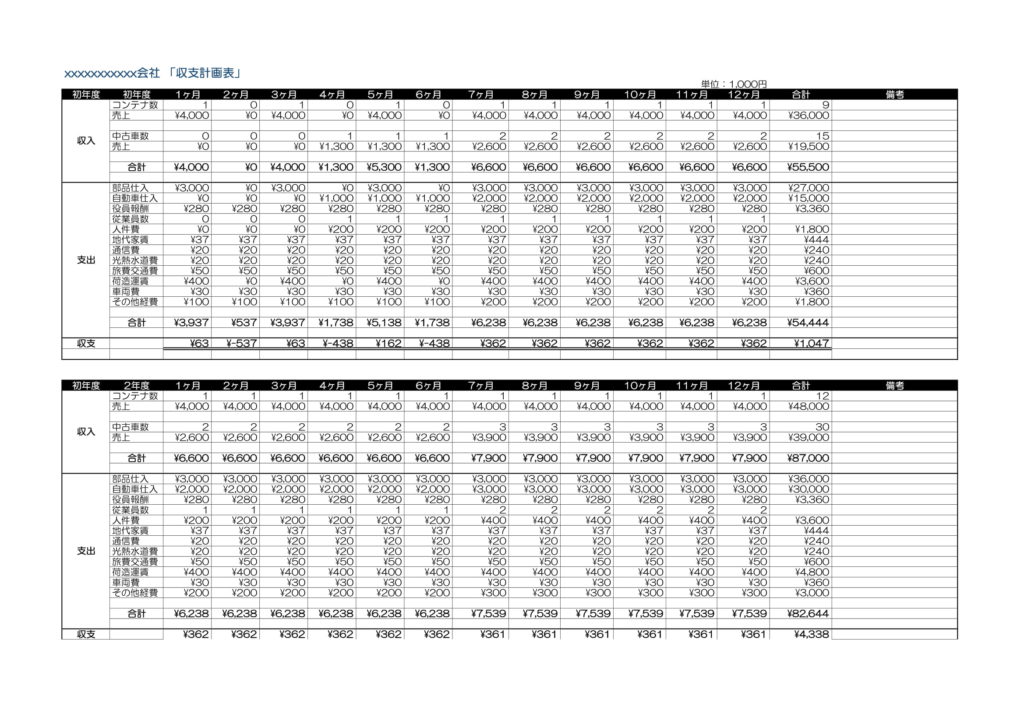

Business Plan 10. Income Statement for 2 Years

The income statement is a table that summarizes monthly sales, expenses, and profits over time. Generally, it’s ideal to create a plan for about three years, but I have only prepared a two-year plan. I thought it would be sufficient as it can fit on one A4 page in landscape orientation.

However, I have obtained permission for this arrangement, so it’s alright.

Here is an example of the table:

In this table, you write down the sales, expenses, and profits for each month from the first month of business to the twelfth month, and then from the thirteenth month to the twenty-fourth month. The profit is accumulated. For example, if the first month has a deficit of 500,000 yen and the second month has a deficit of 400,000 yen, the cumulative profit at that point would be a deficit of 900,000 yen.

Generally, it is prepared on an accrual basis rather than a cash flow basis. If you want to assess the stability of the business, cash flow would be more suitable. However, the immigration office does not require it to that extent.

Should it be in the black from the beginning?

Since it is a plan, it can be written in various ways, but I generally prefer to show a small deficit in the first year and try to recover it in the second year.

If the applicant is allowed to write the plan, they often create overly optimistic and excessively profitable plans. However, immigration officers review various business plans and actually examine financial statements during visa renewals, so if you write an excessively optimistic plan, your planning ability will be doubted.

It is fine to have a break-even point in the profit and loss.

Required Documents for “Business Manager" Visa/Residence Status

The required documents for the application for a “Management and Administration" visa/residence status may vary depending on the nature and circumstances of the business. Below are some examples:

- Application form (Application for Change of Residence Status or Application for Certificate of Eligibility)

- Photo: H4cm x W3cm

- Copy of passport (in the case of Application for Certificate of Eligibility)

- Passport: Presentation (in the case of Application for Change of Residence Status)

- Residence Card: Presentation (in the case of Application for Change of Residence Status)

- Articles of Incorporation of the corporation

- All Matters Certificate (Registration Certificate) of the corporation

- Documents determining the applicant’s remuneration (Minutes of the General Meeting of Shareholders for a joint-stock corporation, Agreement of the employees for a limited liability company)

- Copy of documents submitted to the tax office

- Business plan

- Documentary evidence related to capital of 5 million yen or more

– Taxation certificate of the applicant for 2-3 years, copy of savings account, etc.

– (In case of gift or loan) Documents proving the income of the donor or lender, copy of savings account, documents related to remittance, etc.

– (In case of loan) Money lending contract, repayment plan, letter of reasons from the lender, etc.

– (If there are other investors) Documents proving the income of the other investors for 2-3 years, copy of savings account, etc. - Documentary evidence related to the place of business: Lease agreement, drawings, photographs, etc.

- Contracts with suppliers and sales partners, and other documents proving that the business preparations are progressing

Starting a Business with Permission for Activities Outside Qualifications!

As explained earlier, in order to obtain the “Management and Administration" visa/residence status, it is required to submit documentation that proves the actual operation of the business. However, it can be quite difficult to gather such documents when you haven’t actually started the business.

If the applicant already holds a “Student" or “Dependent" visa, they can start a business within the scope of “Permission for Activities Outside Qualifications".

Generally, “Permission for Activities Outside Qualifications" is considered as permission for part-time jobs or part-time work, but it is not limited to that. The law defines “activities outside qualifications" as follows:

Article 19

5. The content of newly permitted activities subject to conditions in accordance with the provisions of paragraph 2 of Article 19 of the Law shall be any of the following items:

(i) Activities involving the operation of a business with income within 28 hours per week (in the case of a person with a study residence status, within 8 hours per day during a long-term break period specified by the educational institution in which they are enrolled)

Actually, you can engage in business activities with permission for activities outside qualifications.

If you have a “Student" or “Dependent" visa/residence status, you can start your business directly by obtaining permission for activities outside qualifications. By building a track record through this, you can easily obtain a “Management and Administration" visa/residence status.